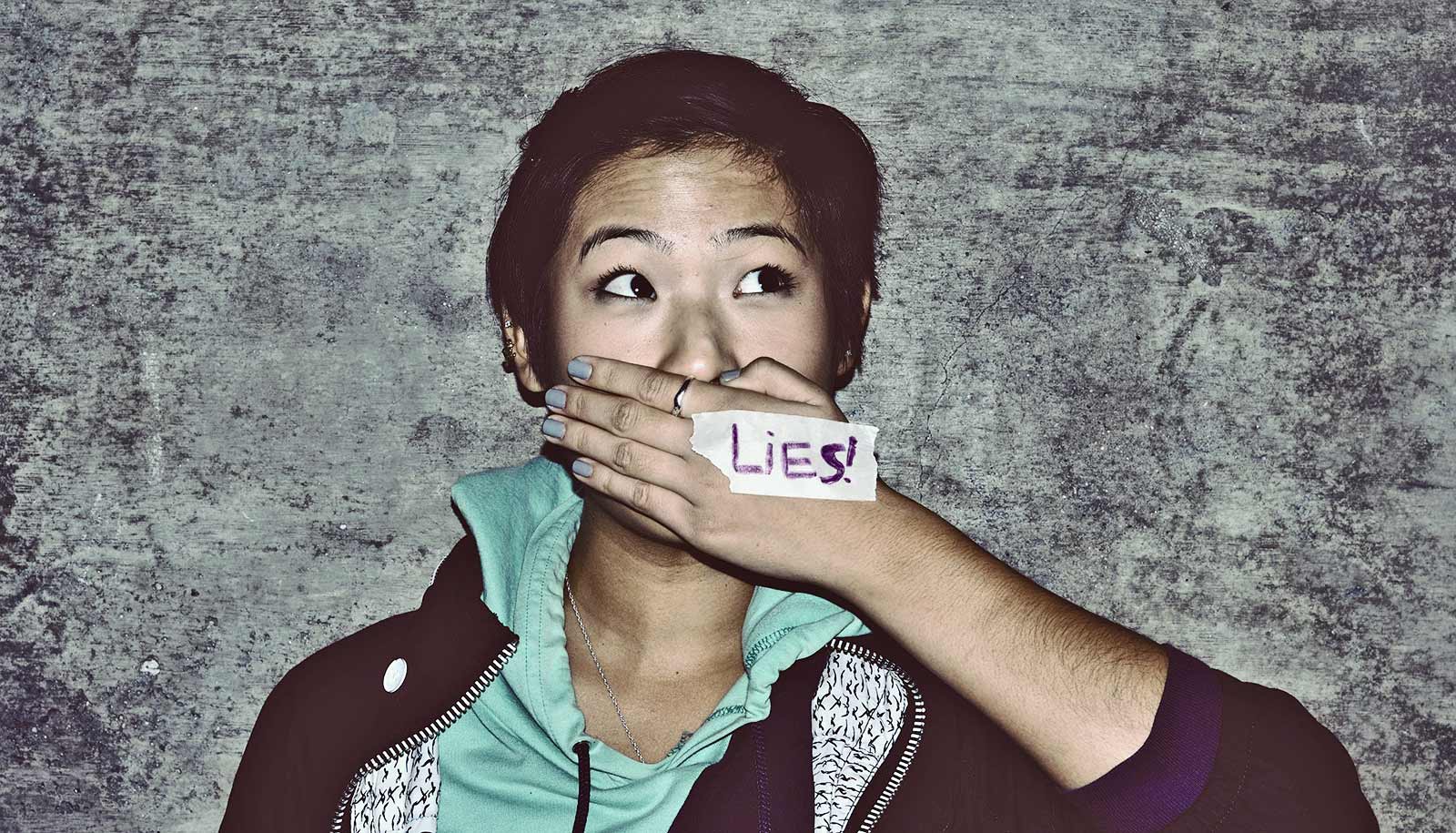

New research digs into when hiding purchases, debt, and savings constitute “financial infidelity,” and provides a means for predicting its occurrence within relationships.

The study is the first systematic investigation of financial infidelity in committed romantic relationships.

Researchers define financial infidelity as “engaging in any financial behavior that is expected to be disapproved of by one’s romantic partner and intentionally failing to disclose this behavior to them.” It involves both the financial “act” and the subsequent concealment.

It differs from secret consumption and merely hiding spending because it involves a broader set of financial behaviors, including seemingly “positive” actions such as saving extra income in a personal bank account.

“Financial infidelity has the potential to be as harmful for relationship health and longevity as sexual infidelity, as conflicts over money are also a primary reason for divorce,” says coauthor Jenny Olson, assistant professor of marketing at Indiana University’s Kelley School of Business. “Given the role that finances play in the health of relationships, consumers benefit from being aware of financial infidelity and its consequences.”

Growing in popularity is financial therapy, which combines finance with emotional support to help individuals and couples think, feel, and behave with money to improve their overall well-being, make logical spending decisions, and face financial challenges.

“An understanding of financial infidelity can benefit financial services companies and advisors, clinical therapists, and relationship counselors, all of whom play a role in promoting consumer well-being,” Olson says. “If couples seek professional financial advice, they must be willing to openly discuss their spending and savings habits, debts, and financial goals. It is clear that financial infidelity is a barrier to effective planning, as well as to a healthy relationship.”

The researchers developed a “financial infidelity scale (FI-Scale)” using a dozen lab and field tests. Key elements include:

- Whether the financial act is expected to elicit any level of disapproval was more important than the degree of disapproval.

- Consumers more prone to financial infidelity exhibited a stronger preference for secretive purchase options, such as using a personal credit card versus a jointly held card, and cash over credit.

- A preference for ambiguous packaging and shopping at inconspicuous stores.

- A greater likelihood of concealing financial information from their partner in a mobile banking app.

Each choice is relevant to marketers. The prevalence of financial infidelity among consumers and variations along the FI-Scale affect purchasing decisions. It is important that companies be aware of certain consumer segments that may be prone to financial infidelity and thus affect their bottom lines.

For example, the trend of businesses going “cash-free” may affect retailers such as beauty salons and gift shops because of the use of cash to disguise purchases. Consumers strategically using cash may be less willing to make purchases only for their pleasure or personal wants.

The research appears in the Journal of Consumer Research.

Additional coauthors are from the University of Notre Dame, University College London, and Boston College.

Source: Indiana University