In a first-of-its-kind study, researchers have discovered an extraordinary surge in the utilization of weight loss-associated GLP-1 receptor agonists that is poised to accelerate, based on emerging clinical evidence.

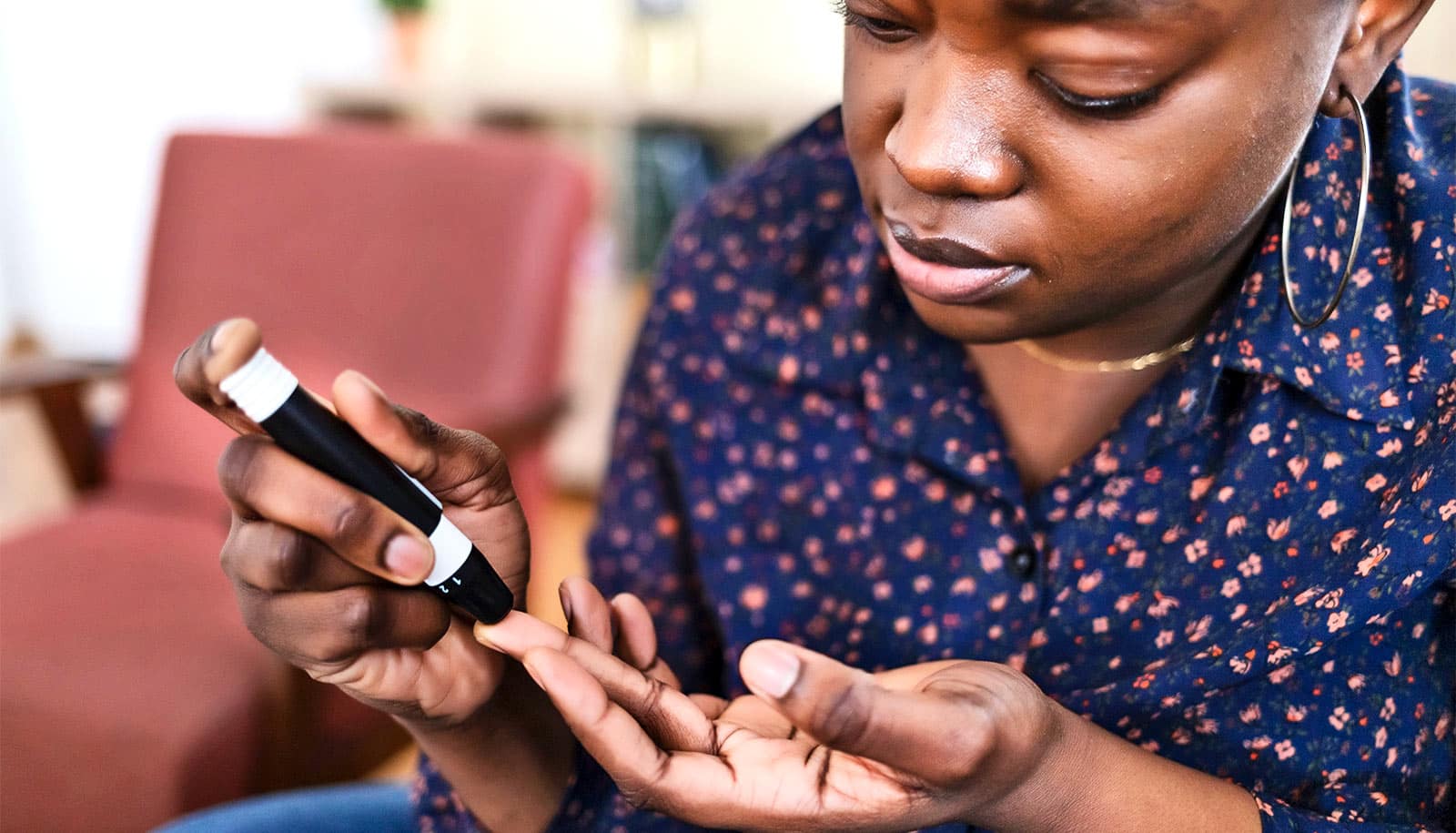

These are a class of medications commonly used in the treatment of Type 2 diabetes and obesity. A GLP-1 agonist is a drug that activates certain receptors in the brain and pancreas.

Findings recently published online in the Journal of the American Pharmacists Association are based on a longitudinal cohort study of patients in the University of California Health Data Warehouse who were prescribed Adlyxin, Byetta, Mounjaro, Ozempic, Rybelsus, Saxenda, Victoza, Trulicity, or Wegovy GLP-1 products between 2014 and 2022.

The results demonstrated rapidly increased usage that’s expected to continue exponentially.

Understanding the impact of this substantial shift in utilization patterns is crucial for informed decision-making by health care providers, ensuring supply stability for patients who rely on these medications, and assessing the economics of the insurance companies that cover the cost of these drugs.

“Before now, there hasn’t been much information available on patient-level, longitudinal use patterns, and the recent FDA approval of GLP-1 RAs linked to substantial weight loss has generated great interest in demand projections,” says Jonathan Watanabe, lead author of the study and a professor of clinical pharmacy at the University of California, Irvine.

“The results from our study of a large, diverse, statewide health system population promise to reshape the conversation around weight loss-associated GLP-1 RAs, informing health care stakeholders, policymakers, legislators, providers, and patients alike.”

The study sample comprised 87,935 people, of whom 47.6% were white, 22.4% were Hispanic, 7.9% were Asian, and 5.7% were Black. The mean age was 59.2 years, and 55.5% were female. Growth rates were estimated according to log-linear regression model analysis.

Between 2014 and 2018, only Trulicity and Victoza exceeded 5,000 annual users. Between 2018 and 2022, when Ozempic was introduced, GLP-1 RA utilization experienced rapid acceleration. By 2022, Ozempic and Trulicity had become the most popular, at 22,891 and 19,663 patients, respectively, while usage had grown to 5,937 for Rybelsus, 2,992 for Wegovy, 2,721 for Saxenda, and 1,508 for Mounjaro. Victoza had dipped to 4,157 users, and Byetta and Adlyxin use was limited throughout the study period.

“This study also highlights that distinct FDA-approved uses for either diabetes or weight loss require that the priorities of patient population medical needs must be balanced,” Watanabe says.

“For example, Ozempic is approved for diabetes, which is much more likely to be medically managed than being overweight. Wegovy and Ozempic are both semaglutide injections, but Wegovy is FDA-approved for weight management rather than diabetes, which impacts its use.”

The next steps of the research will focus on expanding population-level research on use and access.

This work was partially supported by an unrestricted fund from the California Health Benefits Review Program.

Source: UC Irvine